The City of Chestermere is offering Property Tax and Utility Monthly Payments Deferral Programs for residents in response to COVID-19.

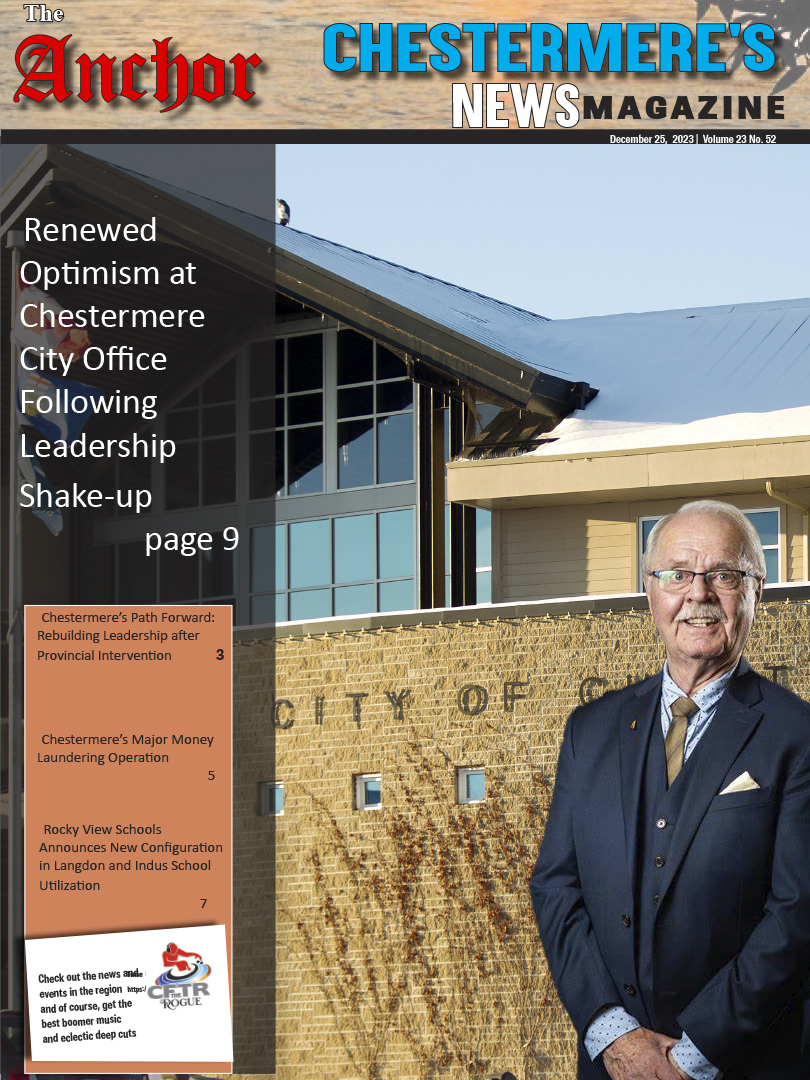

“In my conversations with colleagues right across the province, every municipality is looking at following in line with the province’s strong recommendation to provide relief for citizens in this pandemic time,” said Mayor Marshall Chalmers.

The City of Chestermere payment deferral programs for electricity and natural gas companies are aligned with deferral programs offered by the Federal Government through the Canada Revenue Agency.

“The design of the deferral programs was to make it easy to understand, easy to apply, and provide financial relief to our residents and local businesses during an uncertain and disruptive period,” said the Chief Financial Officer Brenda Hewko.

The Utility Monthly Payment Deferral Program is designed for residents and businesses who need to pause their utility bill payments temporarily because of financial hardships due to COVID-19.

The utility payment deferral can be requested for up to three months beginning April 1 to June 30.

During this time, monthly bills will continue to be sent out, and no interest or penalties will be applied against any utility account.

The repayment plan is structured to ensure financial hardships are avoided and encourage automatic monthly payments.

To ensure repayment for both programs does not occur at the same time, there will be sequential chronological order for repayments.

The utility repayment plan will begin in July and be fully repaid in November.

Participants of the programs must enroll in the automatic Utilities Pre-authorization Payment Program (PAPP), and they must enroll in the electronic delivery of monthly utility bills.

No interest or penalties will be charged for those participants who follow the repayment program requirements.

However, if a resident agrees to a different repayment plan, such as mailing, paper bills or self-initiated payments, then interest and/or penalties would apply by July 1.

The Property Taxes Monthly Payment Deferral Program has been designed for residents and businesses who need to temporarily pause their city property tax payments due to COVID-19.

The property tax payment deferral can be requested for up to five months beginning April 1 to Sept. 1.

In the past, the property tax deadline has been July 31. However, it is now planned for Sept. 1.

No interest or penalties will be assessed against any tax account balances in arrears.

Any accounts that are bound by a tax agreement will not benefit from the relief of interest or penalties, and these accounts will be handled on a case-by-case basis.

Much like the Utility Monthly Payment Deferral Program, to ensure repayment of both programs does not occur at the same time, the Property Tax Payment Deferral Program repayment will begin in December and be repaid fully by September 2021.

The participants of the Property Tax Payment Deferral Program must enroll in the Tax Installment Payment Plan (TIPPs), and they must enroll in the electronic delivery of Property Tax Assessments and Property Tax Notices.

Any taxpayer who is currently on TIPPs can choose to cancel this agreement, as this is a voluntary pre-payment of the current year taxes program.

No interest or penalties will be charged for those participants who follow the repayment program requirements.

If a participant agrees to a different repayment plan, interest and/or penalties would apply by Sept. 1.

“The design of the repayment program is to encourage automation and to continue to provide financial relief during the repayment phase,” Hewko said.

The City of Chestermere is funding both the Utility Monthly Payment, and Property Tax Deferral Programs.

A projection of the financial requirement using 75 per cent of participants in both deferral programs for the entire period determined that the financial impact would be a short-term cash flow need of $10.7 million.

This is considered an extreme scenario.

Each one per cent change in participation rate equates to approximately $100,000 change in the cashflow requirement.

The TD bank is willing to work with the city to provide the short-term financing and the city has adequate debt limit capacity to accommodate the financing of this program if it is required, Hewko said.

Moving forward, bylaw or policies needed by the end of June for the electronic delivery of tax notices, and analysis of the anticipated cash flow to support deferral programs will be presented to council in May.

Options being considered for the funding requirement include, the ability to fund through the cash balance in the bank account, cancelled operating expenses, deferred payments for operating expenses, deferred or alternative funding for capital projects, pausing principle, interest, or payments on existing debt, short-term operating debt, and withdrawing from Stabilization Restricted Surplus Account.